Are you a UK resident looking for financial stability, robust privacy, and the chance to diversify your assets? If so, a Swiss bank account could be exactly what you need. Switzerland’s AAA-rated economy, political neutrality, and world-class financial services create an ideal environment for growing and safeguarding your wealth. Thanks to the Berne Financial Services Agreement, gaining access to Swiss banking from the UK is now smoother than ever.

In this detailed guide, you will learn:

The added perks of working with Mamytova Consulting—including our totally free support in matching you with the most suitable Swiss bank

- How to open a Swiss bank account from the UK

- Why Switzerland stands out as a global safe haven

- The practical steps to secure and maintain a Swiss bank account

- Tips for ensuring full tax compliance

1. Why Switzerland Appeals to UK Citizens

Switzerland has been synonymous with wealth protection, discretion, and financial innovation for decades. As a UK citizen exploring offshore banking options, you might ask yourself: What sets Switzerland apart from other banking destinations?

- Stability: Switzerland’s track record of political neutrality and consistent economic policies shields your funds from unexpected turmoil.

- Regulatory Excellence: Swiss banks regularly top global assessments for banking security, capital requirements, and client confidentiality—while still complying with international regulations.

- Advanced Services: From private wealth management to cutting-edge fintech platforms, Swiss banks offer a full suite of services designed to meet both simple and complex needs.

Bottom Line: If you want a reliable, transparent, yet private environment for your assets, Swiss banking has proven itself time and again.

2. The Berne Financial Services Agreement

In December 2023, Switzerland and the UK signed the Berne Financial Services Agreement, signaling a new era for cross-border banking. This milestone:

- Removes Physical Barriers: Swiss banks no longer need to establish local branches in the UK, provided they meet certain standards.

- Simplifies Client Onboarding: UK residents can open accounts more quickly due to streamlined compliance checks.

- Broadens Investment Opportunities: You gain direct access to Swiss investment products and wealth management solutions without extra red tape.

Why It Matters for You: The Berne Agreement paves the way for seamless capital flow between two major financial powerhouses—London and Zurich. In other words, you can tap into premium Swiss banking services while residing in the UK, enjoying benefits like multi-currency accounts and specialized wealth planning.

3. Core Strengths of the Swiss Economy

Before committing to an offshore bank account, it is wise to assess the economic fundamentals of the host country. Switzerland consistently ranks among the most financially robust nations, thanks to three main pillars:

3.1 AAA Credit Rating and Low External Debt

Switzerland’s AAA credit rating speaks volumes about its ability to fulfill financial obligations, even in turbulent times. Coupled with minimal external debt, this rating offers peace of mind to UK citizens who want to safeguard their assets from economic shocks.

3.2 Large Currency Reserves

As of December 2024, the Swiss National Bank (SNB) held about 808.0 billion USD in foreign exchange reserves. This substantial reserve enables the SNB to intervene in currency markets when necessary, thus stabilizing the Swiss franc and shielding account holders from extreme fluctuations.

3.3 Political Neutrality and Consistent Policies

Switzerland’s neutral stance keeps it out of most global conflicts, leading to steady, predictable governance. Consequently, Swiss banking and tax laws rarely undergo abrupt changes that could jeopardize foreign investments.

Key Takeaway: These robust fundamentals make Switzerland a safe haven—and by extension, an attractive choice for UK residents looking for solid and long-term asset growth.

4. Ensuring Security: Swiss Deposit Protection

4.1 esisuisse Deposit Insurance

Many people associate Swiss banking with safety, and for good reason. Through esisuisse, eligible depositors receive up to CHF 100,000 of insurance per account per bank in the rare event of a bank default. This coverage complements Switzerland’s already high banking standards, acting as an extra safety net for your funds.

4.2 Ongoing Alignment with Global Standards

To uphold its reputation for excellence, Switzerland periodically revisits and updates deposit protection regulations to match or exceed international benchmarks. Thus, when you move your savings from the UK into a Swiss account, you benefit from a system that stands among the world’s most robust.

Did You Know?

Actual bank defaults in Switzerland are extremely rare, thanks to the country’s high capital requirements and conservative lending practices.

5. Power of Currency Diversification

In a world filled with economic ups and downs, placing all your funds in one currency can be risky. Swiss bank accounts for UK citizens often include multi-currency options, letting you spread your investments across the Swiss franc (CHF), euro (EUR), US dollar (USD), and, of course, the British pound (GBP).

5.1 Why the Swiss Franc (CHF) Stands Out

The Swiss franc has long been labeled a safe haven currency. During market downturns, investors traditionally flock to the CHF, buoying its strength and offering a potential hedge against losses in other currencies.

5.2 Personalized Advice for Smarter Diversification

Swiss banking professionals often provide one-on-one consultations to align your currency holdings with your specific financial strategy. This might include shifting a percentage of your portfolio into CHF when indicators suggest a slowdown in the UK or EU. By balancing currencies, you can better protect your assets against inflation or currency devaluation in any single market.

6. Swiss Banking Technology and Expertise

Swiss institutions marry centuries of banking tradition with cutting-edge fintech, ensuring you receive top-notch service and convenience.

6.1 Advanced E-Banking Platforms

Most Swiss banks offer secure, user-friendly online portals for quick transactions, portfolio monitoring, and even advanced analytics. Stringent authentication processes keep your account protected from unauthorized access.

6.2 Data-Driven Portfolio Management

Sophisticated software tools gather and analyze real-time market data. By leveraging these tools, Swiss bankers can alert you to favorable opportunities and help fine-tune your portfolio at just the right moments.

6.3 Dedicated Client Advisors

High-net-worth or complex portfolios often benefit from a personal relationship manager. This expert assists with international tax laws, estate planning, and cross-border financial strategies—all tailored to help you meet your unique goals and stay aligned with both Swiss and UK regulations.

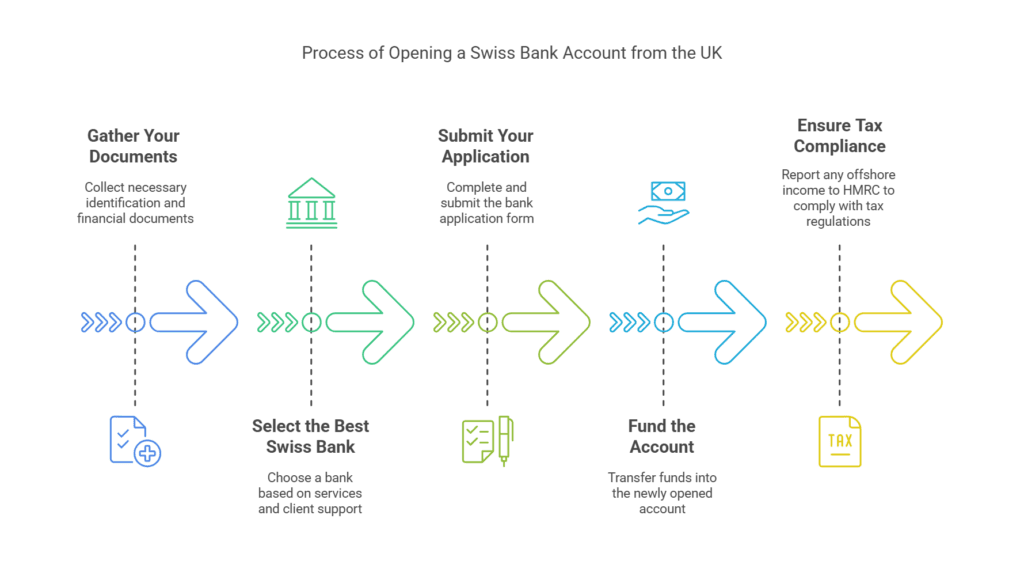

7. How to Open a Swiss Bank Account from the UK

Opening a Swiss bank account from the UK is straightforward, especially under the Berne Financial Services Agreement. Here’s the typical roadmap:

- Gather Your Documents

- Proof of Identity: Passport or driver’s license

- Proof of Address: Recent utility bill or bank statement (within the last three months)

- Source of Funds: Payslips, business revenue, or investment statements

- Tax Compliance (HMRC): Be ready to disclose offshore income

- Select the Best Swiss Bank

- Minimum Deposit Requirements: Some banks may begin at 250,000 GBP, while others are more flexible

- Services and Specializations: Confirm if the bank offers multi-currency support, private wealth management, or corporate services

- Track Record with UK Clients: Look for institutions known for serving clients from the UK

- Submit Your Application

- Complete the bank’s application—often possible online

- Expect a short interview (virtual or in-person) to discuss your goals and confirm your identity

- Fund the Account

- Transfer money in GBP, CHF, or other currencies

- Set up additional sub-accounts, if needed, for multiple currencies

- Ensure Tax Compliance

- Under AEOI (Automatic Exchange of Information), Swiss authorities share relevant data with HMRC

- To avoid penalties, accurately report any offshore income to HMRC

Free Help Every Step of the Way: At Mamytova Consulting, we offer totally free support for UK citizens looking to identify the perfect Swiss bank. We’ll also guide you through each phase—so you can open your account confidently and efficiently.

8. Additional Benefits for UK Clients

Swiss banks don’t just keep your money safe; they also provide a range of value-added services:

- Personalized Relationship Management: You’ll be assigned a dedicated contact who understands your specific situation and can offer tailored solutions.

- Estate and Succession Planning: Seamlessly manage generational wealth transfers, even if your family or business spans multiple countries.

- Worldwide Investment Opportunities: Access equity markets, bonds, hedge funds, private equity, and more—often in multiple currencies.

- Balanced Confidentiality: Swiss banks protect your privacy within a strict legal framework that respects international transparency standards.

9. Possible Drawbacks and Considerations

While Swiss banking is highly appealing, it’s also important to weigh potential challenges:

- Initial Deposit Requirements: Some Swiss institutions maintain high minimum thresholds

- Exchange Rate Exposure: Diversification helps, but currency conversions can still work against you at certain times

- Compliance and Advisory Fees: You might need specialized legal or tax counsel, which adds costs

- Annual and Transaction Fees: Swiss banks often charge fees for account maintenance, wire transfers, and portfolio reviews

10. Why Choose Mamytova Consulting?

At Mamytova Consulting, we focus on making opening a Swiss bank account from the UK as smooth and transparent as possible. Here’s how we stand out:

- Totally Free Support for UK Citizens: We’ll match you to the Swiss bank that aligns perfectly with your financial goals—at no cost to you.

- Expert Guidance: Our team knows the nuances of UK-Swiss regulations and can help you steer clear of common pitfalls.

- Personalized Action Plan: From collecting the right documents and support with KYC preparation to selecting sub-accounts, we provide a customized roadmap for your Swiss banking journey.

- Ongoing Consultation: Once your account is set up, we remain available to offer strategic insights on investments, taxation, and currency diversification.

Ready to Begin?

Contact Us for a free consultation, and we’ll show you how to open a Swiss bank account from the UK quickly, securely, and in full compliance with HMRC rules.

11. Final Thoughts

The Berne Financial Services Agreement has significantly opened the door for UK citizens to explore Swiss bank accounts without the usual cross-border complications. By investing in Switzerland, you leverage a stable currency, top-tier regulations, and advanced banking technology. Moreover, you gain access to a broad spectrum of global markets to invest and make fiduciary depoits, backed by a personalized Swiss approach that prioritizes your unique financial vision.

Whether you’re seeking asset protection, growing wealth offshore, or simplifying a global investment strategy, Switzerland offers tangible advantages. With professional support, the entire journey—from choosing the right bank to staying tax compliant—becomes far less daunting.

Disclaimer

This guide is meant for general informational purposes and does not constitute legal, tax, or financial advice. UK residents should verify specific HMRC requirements for reporting offshore income. Always consult qualified professionals to address individual circumstances before opening or maintaining a Swiss bank account.